Some Ideas on Custom Private Equity Asset Managers You Should Know

Wiki Article

Custom Private Equity Asset Managers for Beginners

(PE): investing in business that are not publicly traded. Roughly $11 (https://codepen.io/cpequityamtx/pen/VwgqKQX). There might be a couple of points you do not understand regarding the market.

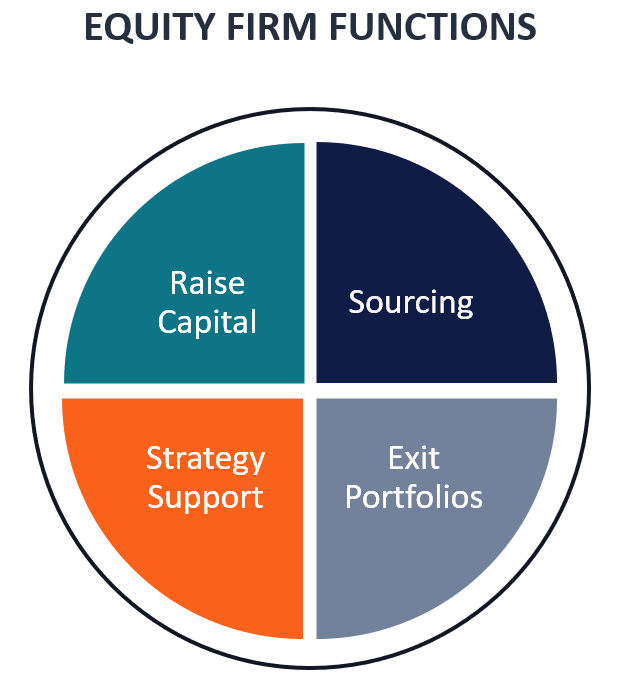

Companions at PE companies elevate funds and take care of the cash to yield favorable returns for investors, usually with an financial investment perspective of in between 4 and 7 years. Personal equity firms have an array of financial investment choices. Some are strict financiers or passive investors entirely based on administration to expand the firm and generate returns.

Due to the fact that the most effective gravitate towards the larger bargains, the center market is a considerably underserved market. There are extra sellers than there are extremely seasoned and well-positioned finance experts with extensive buyer networks and sources to manage a deal. The returns of private equity are generally seen after a couple of years.

Not known Factual Statements About Custom Private Equity Asset Managers

Flying listed below the radar of huge international firms, numerous of these little business often offer higher-quality customer care and/or particular niche services and products that are not being offered by the huge conglomerates (https://www.easel.ly/infographic/p8uz4g). Such benefits bring in the interest of exclusive equity firms, as they possess the insights and savvy to exploit such possibilities and take the business to the following level

Exclusive equity financiers need to have reputable, capable, and reliable management in position. Most supervisors at portfolio firms are provided equity and bonus offer settlement structures that compensate them for striking their financial targets. Such placement of objectives is normally called for before a bargain gets done. Private equity possibilities are frequently unreachable for individuals who can not spend millions of dollars, however they shouldn't be.

There are policies, such as restrictions on the aggregate pop over to this web-site amount of cash and on the number of non-accredited financiers. The personal equity company draws in some of the best and brightest in corporate America, including leading entertainers from Ton of money 500 firms and elite management consulting companies. Law office can also be hiring grounds for exclusive equity employs, as audit and lawful abilities are needed to complete bargains, and purchases are highly demanded. https://anotepad.com/note/read/gtek6cnk.

Custom Private Equity Asset Managers for Beginners

An additional negative aspect is the lack of liquidity; once in a private equity purchase, it is not very easy to get out of or sell. With funds under management currently in the trillions, private equity companies have come to be attractive financial investment vehicles for well-off people and institutions.

For decades, the characteristics of private equity have actually made the asset course an attractive recommendation for those that could get involved. Now that access to private equity is opening as much as even more private financiers, the untapped possibility is coming true. The question to consider is: why should you spend? We'll start with the major arguments for purchasing exclusive equity: How and why private equity returns have historically been more than various other possessions on a variety of levels, Just how consisting of personal equity in a profile affects the risk-return profile, by helping to diversify versus market and intermittent threat, After that, we will describe some essential considerations and dangers for exclusive equity capitalists.

When it concerns introducing a brand-new asset into a portfolio, one of the most basic factor to consider is the risk-return profile of that property. Historically, exclusive equity has actually exhibited returns similar to that of Arising Market Equities and more than all various other traditional possession classes. Its reasonably reduced volatility combined with its high returns creates an engaging risk-return profile.

10 Easy Facts About Custom Private Equity Asset Managers Explained

Actually, exclusive equity fund quartiles have the widest array of returns across all alternative asset classes - as you can see below. Method: Interior price of return (IRR) spreads computed for funds within classic years individually and after that balanced out. Median IRR was computed bytaking the average of the median IRR for funds within each vintage year.

The takeaway is that fund option is important. At Moonfare, we bring out a rigorous choice and due diligence process for all funds provided on the system. The impact of including private equity right into a portfolio is - as constantly - based on the portfolio itself. A Pantheon study from 2015 recommended that including exclusive equity in a profile of pure public equity can unlock 3.

On the various other hand, the most effective private equity companies have access to an also bigger pool of unknown possibilities that do not encounter the exact same analysis, in addition to the sources to do due persistance on them and recognize which deserve spending in (Syndicated Private Equity Opportunities). Spending at the ground floor implies higher threat, however, for the business that do succeed, the fund take advantage of higher returns

Custom Private Equity Asset Managers Can Be Fun For Anyone

Both public and exclusive equity fund supervisors dedicate to investing a percent of the fund however there remains a well-trodden issue with lining up rate of interests for public equity fund management: the 'principal-agent issue'. When an investor (the 'principal') works with a public fund manager to take control of their funding (as an 'representative') they delegate control to the manager while maintaining possession of the properties.

In the situation of private equity, the General Partner doesn't just make a management cost. Exclusive equity funds likewise reduce an additional type of principal-agent problem.

A public equity investor ultimately desires one point - for the monitoring to boost the stock rate and/or pay out rewards. The investor has little to no control over the decision. We showed above the amount of personal equity methods - specifically bulk buyouts - take control of the running of the firm, making certain that the long-lasting value of the firm comes first, rising the roi over the life of the fund.

Report this wiki page